The income tax rate for foreigners in Argentina ranges from 5% to 35% depending on how much income you earn throughout the year. Just like in the US, the Argentina tax year runs from January 1 to December 31.

Do you have to pay taxes in Argentina?

Individuals resident in Argentina are taxable on worldwide income and may obtain a foreign tax credit for taxes paid on income from foreign sources. Non-residents and foreign beneficiaries are only taxable on their Argentine-source income.

Do foreigners pay tax in SA?

South Africa has a residence-based tax system, which means residents are, subject to certain exclusions, taxed on their worldwide income, irrespective of where their income was earned. By contrast, non-residents are taxed on their income from a South African source.

Is it cheap to live in Argentina?

According to numbeo.com, the cost of living in Argentina is 50% to 60% less than in the U.S. All told, a couple can expect to live comfortably on $1,500 to $1,800 per month. Single individuals can expect to get by on about $1,000 per month. In particular, housing in Argentina is quite affordable by U.S. standards.

Do foreigners have to pay taxes?

Nonresident aliens are generally subject to U.S. income tax only on their U.S. source income. They are subject to two different tax rates, one for effectively connected income, and one for fixed or determinable, annual, or periodic (FDAP) income.

Can foreigners live in Argentina?

All individuals wishing to settle in Argentina must apply for a residence permit. Foreigners are automatically considered settled in Argentina upon entry under an entry permit and visa. If applicable, they are then able to obtain their national identity document from the civil registry.

What is the lowest tax paying country?

There are currently 14 countries with zero income tax in the world: Antigua and Barbuda, St. Kitts and Nevis, United Arab Emirates, Vanuatu, Brunei, Bahrain, the Bahamas, Bermuda, Cayman Islands, Monaco, Kuwait, Qatar, Somalia, and Western Sahara.

Is Argentina cheap for expats?

Argentina is one of the most affordable countries to live in. Food, property, and rent are affordable. That being said, imports like clothing and electronics are sometimes double the cost of what you'd pay in Europe and North America.

How do non citizens pay taxes?

Nonresident aliens who are required to file an income tax return must use Form 1040-NR, U.S. Nonresident Alien Income Tax Return.

Which country has no foreign income tax?

Some of the most popular countries that offer the financial benefit of having no income tax are Bermuda, Monaco, the Bahamas, and the United Arab Emirates (UAE). There are a number of countries without the burden of income taxes, and many of them are very pleasant countries in which to live.

Can I be a tax resident in 2 countries?

It is possible to be resident for tax purposes in more than one country at the same time. This is known as dual residence.

Are foreigners taxed?

A nonresident alien (for tax purposes) must pay taxes on any income earned in the U.S. to the Internal Revenue Service, unless the person can claim a tax treaty benefit.

Can a foreigner live in Argentina?

All individuals wishing to settle in Argentina must apply for a residence permit. Foreigners are automatically considered settled in Argentina upon entry under an entry permit and visa. If applicable, they are then able to obtain their national identity document from the civil registry.

Is healthcare free for foreigners in Argentina?

Public Healthcare in Argentina The Argentinian public healthcare system is free for everyone. And by everyone, we don't just mean the locals. Expats and tourists can also make use of the government-funded programs.

Is Argentina friendly to foreigners?

Foreigners can easily live in Argentina. In fact, Argentina is one of the most friendly countries for expats. People from dozens of countries can enjoy visa-free stays for up to 90 days. For people wanting to call this South American wonderland home, there are plenty of visa options.

Can a foreigner buy a car in Argentina?

You'll need your passport, driver's license, and proof of residency (a DNI for Argentinian residents or an CDI for foreigners). If you're planning on financing the purchase, you'll also need proof of employment and income in Argentina.

Is medical free in Argentina?

The Argentinian public healthcare system is free for everyone. And by everyone, we don't just mean the locals. Expats and tourists can also make use of the government-funded programs. Inpatient and outpatient care is completely free.

Can a foreigner buy a house in Argentina?

How To Own Real Estate in Argentina. To own property in Argentina, a foreigner needs to have a CDI (equivalent to a tax ID number in the United States, Canada, and Europe). Foreigners are only permitted to buy property in this region if they can prove it will benefit the local community.

Why do people leave Argentina?

“The bad policies of all governments and the lack of the rule of law, among other factors, have caused a large number of Argentines to want the same as us, to leave.”

How long can a foreigner stay in Argentina?

An Argentina visa is valid for three months and allows multiple entries into the country. You can stay in the country for up to 90 days. For long-term purposes (work or study), you have to get a residence permit upon arrival if you want to be allowed to stay for longer than 90 days.

Can you leave the country to avoid taxes?

Avoiding U.S. Taxes While Living Overseas Under the U.S. tax laws currently in place, there is no way for an American citizen to avoid filing a tax return and paying the related taxes except by renouncing their U.S. citizenship.

Why do foreigners not have to pay taxes?

Because their immigration status prevents them from qualifying for a social security number, applying and receiving an ITIN allows non-U.S. citizens to submit a tax return and pay any tax they owe to the federal government.

Do dual citizens have to pay taxes in both countries?

For individuals who are dual citizens of the U.S. and another country, the U.S. imposes taxes on its citizens for income earned anywhere in the world. 5 If you are living in your country of dual residence that is not the U.S., you may owe taxes both to the U.S. government and to the country where the income was earned.

Is it hard to get Argentina citizenship?

It sets forth very simple requirements: be 18 years old or older; have been living in Argentina for a minimum of 2 years; and. apply for naturalization before a federal judge.

Is Argentina a friendly country?

Argentines are warm, friendly, open and generous, and will thinking nothing of inviting you to a barbeque even if you have only met them once. They will happily help you move house and even forgive your beginner's Spanish.

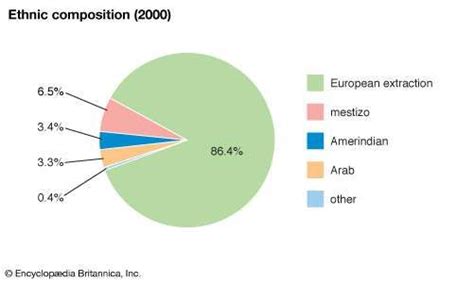

Why did so many Europeans go to Argentina?

As the immigration came from several European countries, there was no single reason that led to the immigrants leaving their home countries. Some of them simply sought a better lifestyle, but many others escaped from ongoing conflicts within Europe.